Last Updated: January 23, 2026

Since the launch of ChatGPT, and Claude, a few questions have remained difficult to answer: Which industries and countries are actually leading the way in adoption? Are enterprises in the 1st, 3rd, or 5th inning of adoption?

Existing research have relied mostly on surveys, which are incredibly flawed.

My study takes a completely different approach. Rather than asking companies what they’re doing, I directly observe enterprise LLM deployment by analyzing digital signals that tell us when companies deploy enterprise LLM tools to their employees.

My data comes from tracking corporate domains associated with 76,084 companies with >= 500 employees. I detect specific signals in their DNS configurations that allow me to identify which tool they’re using. I can track these tools: ChatGPT, Claude, Perplexity or Mistral. To be clear, I can’t track Google Gemini, Microsoft Copilot, or any Chinese LLM.

For those in a rush, here are the key sections of my study (you can click through to a particular section you’re interested in)

- How much has adoption of enterprise AI increased among Fortune 500 companies?

- Which industries lead in Enterprise AI adoption?

- Which types of professional services lead in enterprise AI adoption?

- Which regions in the world lead in enterprise AI adoption?

- Which countries in the EU lead in enterprise AI adoption?

- What % of Claude customers also pay for ChatGPT?

- Which types of companies prefers Claude over ChatGPT?

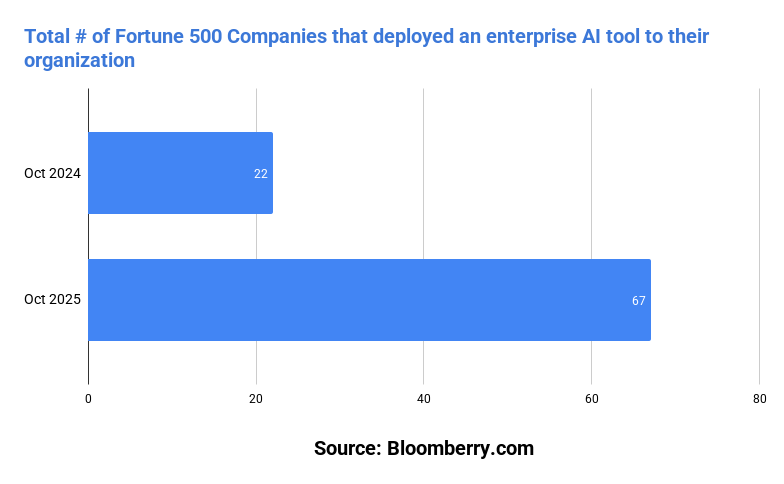

1. Adoption among the Fortune 500 has tripled in the past year.

At this time last year (October 2024), only 22 Fortune 500 companies had deployed at least one enterprise AI LLM platform across their workforce.

As of October 2025, 67 Fortune 500 companies now have deployed an enterprise LLM product (13.4% of the Fortune 500) to their employees. A more than 3x increase from a year ago.

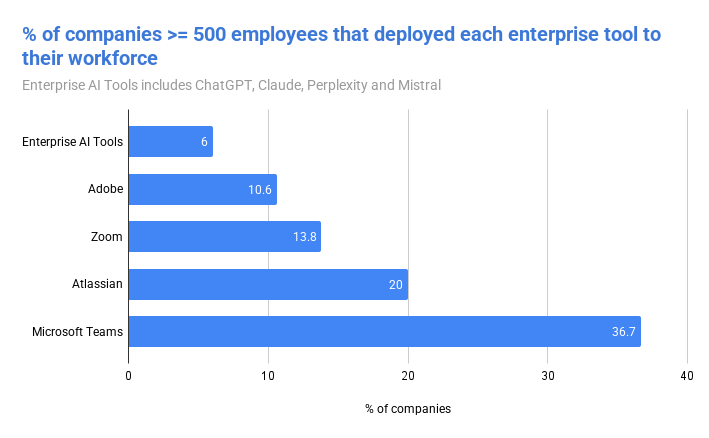

Looking more broadly, 6% of companies with >= 500 employees globally have deployed enterprise LLM tools across their workforce.

To provide some context to how early this is, roughly 20% of these same companies have deployed Atlassian (a mature SaaS product) to their workforce. So if we assume that enterprise LLM platforms will reach the popularity of Atlassian, at its peak, then we’re probably in the 3rd inning right now.

However, if we assume that enterprise LLM platforms will reach the popularity of Microsoft Teams someday, we’re somewhere between the 1st and 2nd inning.

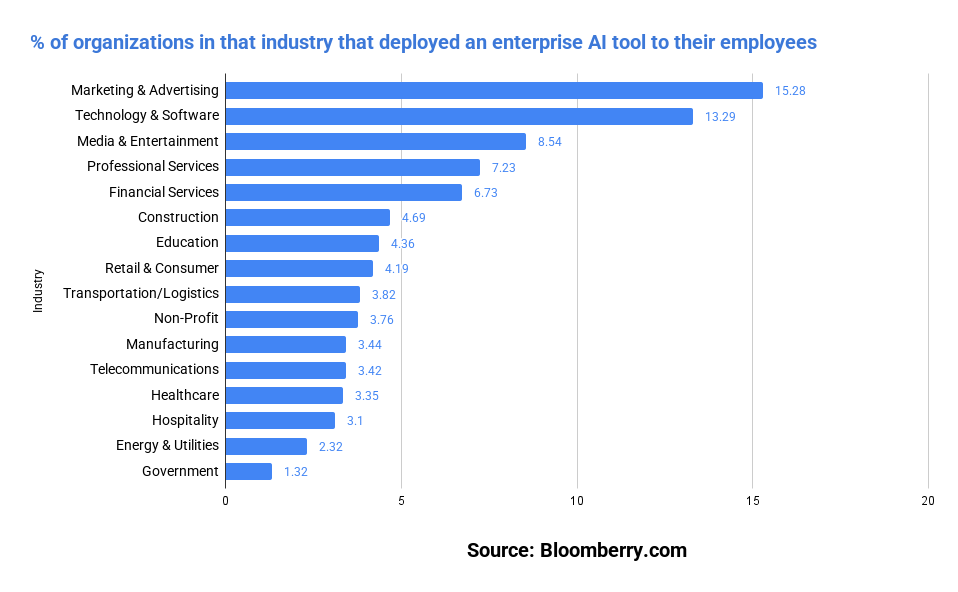

2. Marketing/Advertising companies lead all industries in adoption, followed closed by Tech/Software

Marketing (15.28%) and Tech (13.29%) lead for obvious reasons – marketing firms create a lot of content, and tech companies have both the infrastructure and “try new things” culture baked in. No mystery there.

The real story is in the gaps.

Why is Financial Services (6.73%) adopting 2-3x faster than Healthcare (3.35%) despite similar regulatory scrutiny?

For starters, banks have clear, measurable use cases: customer service chatbots, document review, and compliance monitoring. A bank can A/B test AI on 10,000 support tickets and see exactly how much it saves. Healthcare, on the other hand, can’t do this – medical decisions are too high-stakes. There’s no ethical way to run the experiment.

Construction at 4.69% is surprisingly high – higher than retail (4.19%) and education (4.36%). AI is probably attacking the massive paperwork layer: permits, contracts, change orders, safety documentation.

Telecom companies at 3.42% seemed surprisingly low, as they all have massive customer service operations that should benefit from AI.

Government (1.32%) lagging makes perfect sense: 18-month procurement, risk-averse culture, no competitive pressure. The surprise would be if government weren’t last.

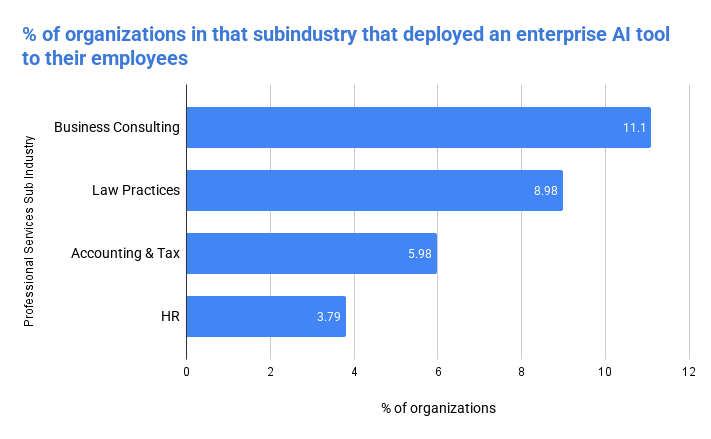

Which Professional Services Are Actually Using AI?

I wanted to delve into professional services, since it encompasses a lot of little sub-industries. Where there subcategories that adopted enterprise AI more than others?

Business consulting leads at 11.10%, slightly ahead of law firms at 8.98%. Consulting makes obvious sense – these firms sell research, and strategic recommendations, which is basically what LLMs do. McKinsey analysts can use AI to synthesize market research or draft client presentations, see immediate productivity gains, and the risk if something’s slightly off isn’t catastrophic (because they’re McKinsey for crying out loud).

Law firms at 8.98% is the surprise here. Legal work has genuine malpractice risk – an AI hallucination in a contract could be a lawsuit. Yet surprisingly, law firms are adopting at nearly the same rate as consultants. And remember, this is excluding existing popular law AI tools like Harvey AI.

Accounting at 5.90% seems surprisingly low to me, but it probably reflects genuinely murky use cases. Accounting work is about numbers, compliance, and structured data – not really where LLMs shine the most. The firms that adopted are probably using AI for client communications and advisory work, not actual audit or tax prep.

HR services at 3.79% are way behind, and honestly it’s not entirely clear why. On paper, HR should be higher – these firms do tons of text-heavy work like job descriptions, employee handbooks, recruiting outreach, and training materials. A possible theory could they’re afraid of discrimination liability?

Whatever the reason, HR is clearly more hesitant than other professional services, even those with comparable risk profiles.

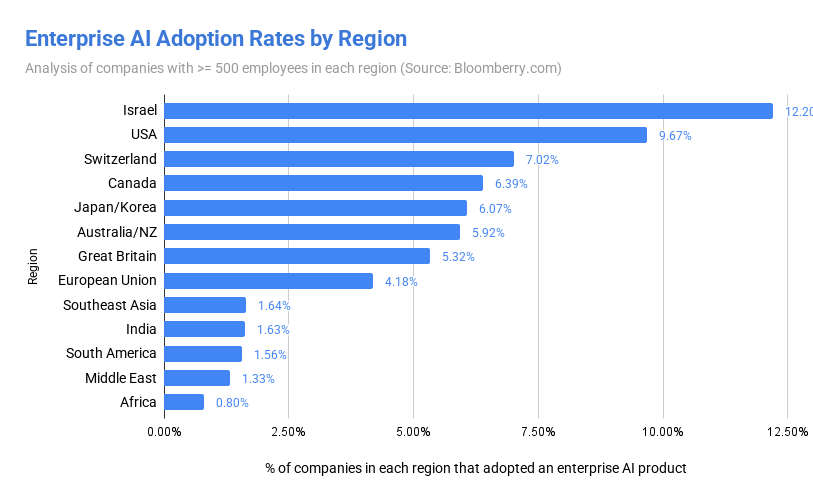

3. Israel and US leads all regions in enterprise AI adoption, with the EU lagging

Enterprise AI adoption reveals a stark geographic reality: adoption rates range from 12.2% in Israel to 1.35% in the Middle East, among large companies worldwide.

The United States dominates with 9.67% of large companies deploying enterprise AI. This probably isn’t surprising to anyone.

But here’s what might be: Israel leads everyone at 12.2%. For a country with a tiny domestic market, this is remarkable. It being the leader reflects its status as a tech powerhouse with deep Silicon Valley connections and a culture of early adoption.

The “rich country club”—Switzerland (7.02%), Canada (6.39%), Australia/New Zealand (5.92%) clusters around 6%, roughly two-thirds the US rate. Switzerland’s 7.02% is particularly notable because it sits outside the EU regulatory framework.

Great Britain at 5.32% occupies an awkward middle ground. Post-Brexit Britain has regulatory independence but hasn’t translated that into US-level adoption (though it is ahead of most of the EU)

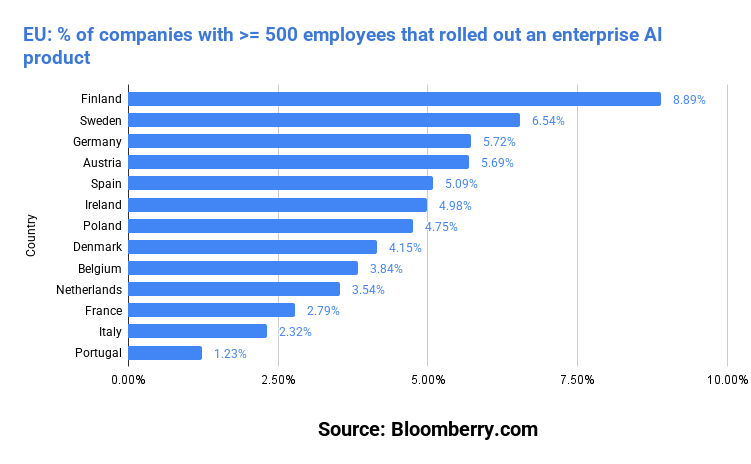

Europe’s Puzzle: Same Rules, Different Results

The European Union shows 4.18% adoption – less than half the US rate. This will probably prompt endless debate about whether EU regulations (the AI Act, GDPR) are “killing innovation.”

But it’s not all uniform, as adoption within the EU varies dramatically: Finland at 8.9% nearly matches the US, while Portugal at 1.2% is closer to emerging market levels. That’s a 7-fold gap within the same regulatory framework.

Finland’s high adoption probably reflects Nokia’s legacy. The country went through a massive tech transformation in the 1990s-2000s when Nokia dominated global mobile phones, building deep technical infrastructure and a culture of early technology adoption across Finnish companies. Even after Nokia’s decline, that institutional knowledge and comfort with new tech stuck around.

France (2.79%), Italy (2.32%), and Portugal (1.2%) clustering at the bottom is harder to explain cleanly. One theory: these are larger Southern European economies with more traditional corporate cultures and stronger labor protections that make workforce transformation politically sensitive.

France in particular has powerful unions and strict employment laws – deploying AI tools that might displace white-collar workers is a more fraught decision than in Finland or Switzerland.

The EU’s aggregate 4.21% compared to 7.02% in Switzerland does suggest regulatory friction plays some role. GDPR and the AI Act probably create compliance costs that particularly burden smaller companies. The regulations aren’t killing innovation, but they’re definitely slowing it down.

4. Almost half of Claude customers are also ChatGPT customers

It’s ChatGPT vs Claude. Only one of them can win this market, right? Well.. maybe not.

To understand competitive dynamics beyond simple market share, we analyzed if a non-trivial # of companies deploy multiple enterprise AI products – and in what order.

The overlap data reveals a striking asymmetry: nearly half of Claude customers (48.66%) also pay for ChatGPT , while only 6.5% of ChatGPT customers pay for Claude.

The timing data exposes the actual market dynamic at play.

| Adoption Sequence | # of companies | Average days between adoption | Percentage of dual adopters |

| ChatGPT first, then Claude | 260 | 128 | 52.4 |

| Anthropic first, then ChatGPT | 102 | 45 | 20.6 |

| ChatGPT first, then Perplexity | 100 | 156 | 20.2 |

| Perplexity first, then ChatGPT | 28 | 15 | 5.6 |

| Claude first, then Perplexity | 4 | 52 | 0.8 |

| Perplexity first, then Claude | 2 | 31 | 0.4 |

The overlap data reveals two distinct adoption patterns.

Pattern 1: Simultaneous Dual Deployment

A significant portion of the dual-vendor companies deployed both platforms within 45 days of each other. These aren’t organizations trying one platform, finding it inadequate, and adding another – they’re probably making the decision to use both from the outset. Just like a lot of companies adopt a multi-cloud strategy, a good number of companies are adopting a multi-AI strategy.

Pattern 2: ChatGPT-First, Claude-Later

The second pattern involves companies that deployed ChatGPT first and added Claude months later. This sequential adoption suggests a different motivation: these organizations standardized on ChatGPT as their primary platform, but over time identified specific use cases (ie. coding) or teams where Claude performed better or offered necessary capabilities ChatGPT lacked.

This could be technical teams needing longer context windows, specialized reasoning tasks where Claude excels, or simply dissatisfaction with ChatGPT’s performance on particular workloads. The decision to add a second expensive enterprise contract indicates the pain point was significant enough to justify the additional cost and complexity.

The One-Way Street

What’s notable is that this multi-vendor behavior is essentially one-directional. While half of Claude customers also use ChatGPT, only 6.5% of ChatGPT customers have added Claude. Organizations that choose ChatGPT typically see no need for alternatives – 91% use it exclusively. But organizations that select Claude – despite it being the less popular choice frequently maintain ChatGPT alongside it.

This asymmetry suggests Claude attracts a specific buyer profile: technically sophisticated organizations with complex requirements who view multi-vendor AI infrastructure as strategic, whether planned from the start or added over time to address ChatGPT’s limitations.

5. Silicon Valley favors Claude. NYC and everyone else favor ChatGPT

When we aggregate all Bay Area tech hubs – San Francisco, San Jose, Mountain View, Palo Alto, and surrounding cities – a striking pattern emerges: Silicon Valley companies adopt Claude at nearly double the rate of New York (5.8% vs 3.42%)

The Claude-to-ChatGPT ratio tells an even clearer story. In Silicon Valley, for every four companies using ChatGPT Enterprise, roughly one also deploys Claude. In New York, that ratio drops to one in six. In London, it’s one in seven.

Why does Silicon Valley favor Claude? One is that more software companies often means engineering tasks – code review, debugging, technical documentation. Which is where Claude’s capabilities (esp. with Claude Code) particularly shine.

A fintech company in New York might primarily use AI for customer service or compliance documents, where ChatGPT’s broader training and integration ecosystem matters more. A software company in Mountain View is more likely to use AI for helping engineers write and review code, where Claude’s technical performance creates measurable productivity differences.

Conclusion

The findings reveal we’re still early – somewhere between the 1st and 3rd inning depending on your assumptions about AI’s ultimate penetration. Only 6% of large companies globally and 13.4% of the Fortune 500 have deployed enterprise AI tools to their workforce.

The adoption patterns tell a clear story about where AI is having immediate impact versus where it faces resistance. Marketing, tech, and professional services are moving fast because the use cases are obvious and the risks are manageable. Healthcare, manufacturing, and energy lag not because they can’t benefit from AI, but because they haven’t figured out how to deploy it safely and measure ROI clearly.

Geography matters more than expected. The 7-fold gap between Finland and Portugal within the same EU regulatory framework suggests culture and industrial structure drive adoption as much as regulation.

The competitive dynamics are more nuanced than simple market share numbers suggest. Claude’s asymmetric relationship with ChatGPT – where nearly half of Claude customers also use ChatGPT, but only 6.5% go the other direction – reveals that enterprises are building multi-vendor AI strategies rather than picking winners. This isn’t a “ChatGPT versus Claude” battle; it’s enterprises figuring out which tools work best for which jobs.

The biggest unanswered question: what happens to the 94% of large companies that haven’t adopted yet? Do they follow the early adopters once ROI becomes clearer, or do they represent industries and use cases where enterprise AI tools simply don’t make sense? The answer will determine whether we’re in the 1st inning or the 3rd right now.

📊 See which companies are adopting these tools

Explore real adoption data for the enterprise AI and infrastructure tools driving transformation: