Wappalyzer is one of the best technology detection tools out there, and as a software engineer, I think their approach is pretty clever. They crowdsource data from everyone using their browser extension – so as people browse the web, Wappalyzer is constantly collecting real-time technology data.

But it's not perfect. It misses backend technologies and the accuracy is hit and miss sometimes.

So I took a weekend to test out some alternatives. I tried 12 different tools, and for each one, I signed up for an actual account and used it in practice, rather than just reading the marketing site. (You'd be surprised how many "comparison" articles don't do this 🙂)

After all that testing, one tool stood out as the clear winner: Bloomberry.

Bloomberry – The Best Wappalyzer Alternative for Enterprise Tech Detection

Bloomberry is the best overall Wappalyzer alternative, especially for sales and lead generation, because it detects technologies that Wappalyzer simply misses.

Unlike Wappalyzer, which focuses primarily on frontend technologies visible on a website, Bloomberry provides data on both web and non-web products. This makes it extremely valuable for sales teams doing lead generation for any SaaS/cloud product.

With Bloomberry, you can find customers of products that typically leave no visible footprint on company websites. These include tools like CRMs like Salesforce, ERPs like Acumatica, AI tools like ChatGPT and project management tools like Atlassian.

Finding Customers Wappalyzer Can't See

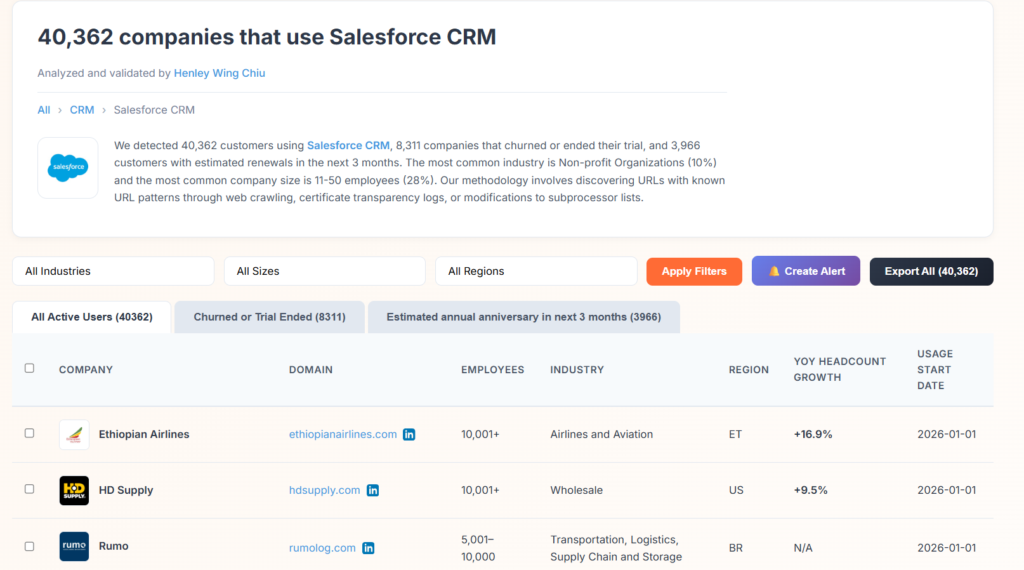

For instance, when I searched for companies that used Salesforce CRM, Bloomberry detected 40,000+ companies that were currently using Salesforce. Companies where their sales teams are actually using Salesforce as a CRM.

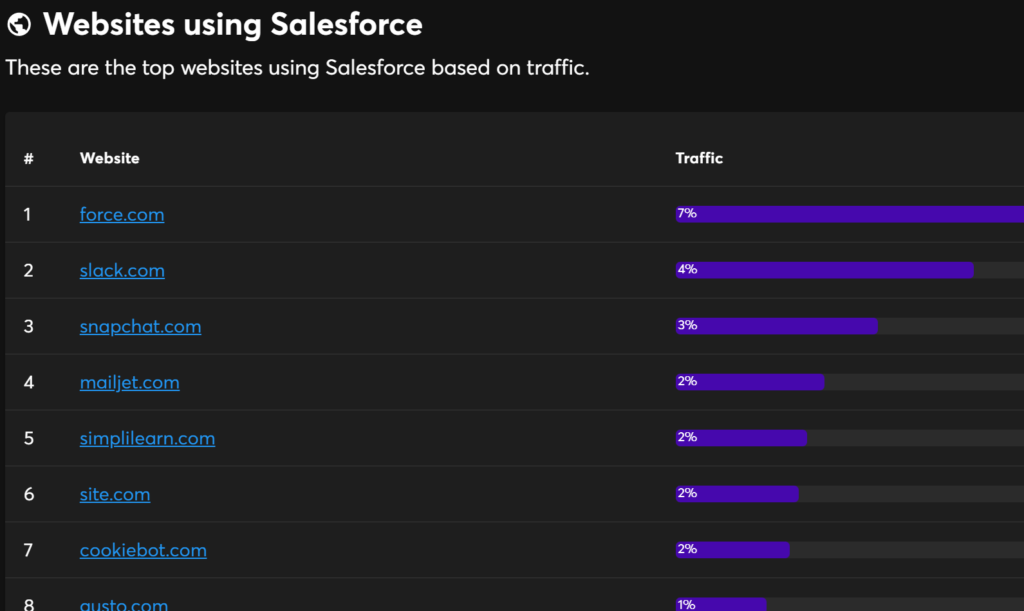

Wappalyzer, on the other hand, is only able to detect companies that show any visible footprint of using Salesforce on their website. This could be anything from using a Salesforce chat or customer service widget (Salesforce Service Cloud), or an analytics tracking script (ie Pardot).

The problem with that? You're not actually finding Salesforce CRM users – you're finding companies that happen to use some Salesforce-adjacent tool on their website. That's a very different audience. If you're selling a Salesforce integration or a competing CRM, the Wappalyzer list won't get you where you need to go.

Detecting Tech Adoption Earlier

Wappalyzer can only see what's on the public webpage. Most backend products never touch the frontend. And even products that do eventually get embedded (like customer success platforms) often go live internally weeks or months before any tracking script appears on the website.

For example, Eightfold started using Gainsight (a customer success platform) in September. Wappalyzer had no way of knowing because there was nothing new on their website. Bloomberry detected that Eightfold signed up for Gainsight on September 18th. We see the actual adoption, not just the tracking script, giving you a 2-3 month head start (or catching customers Wappalyzer misses entirely).

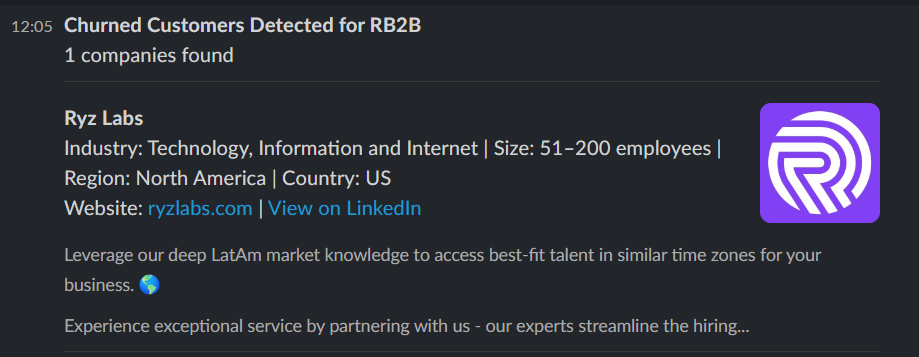

Real-Time Alerts for Sales Triggers

For many products, Bloomberry also tracks in real-time when a company first starts using that product, and when they churned from it. You can get an alert that will notify you via email or Slack when a new company was detected using it, or when a new company was detected dropping it. With Wappalyzer, you just get a static lead list.

Bloomberry's Alerts feature sends notifications to your inbox or Slack channel whenever:

- A new customer signs up for a technology you're tracking (great for competitive displacement or partner outreach)

- A company churns from a product (perfect timing to offer your alternative)

- A renewal is approaching (reach out before the auto-renew locks the budget)

For sales teams, this timing often matters more than anything else. If you're selling Salesforce consulting or implementation services, don't you want to know when a company just started using Salesforce? That's the perfect moment to reach out – they're new to the platform, probably overwhelmed, and actively looking for help.

Smarter Churn Detection

Wappalyzer (like most tools) determines product usage by scanning for JavaScript snippets or tracking tags. The problem? Companies routinely cancel subscriptions but never bother removing the code. The tag sits there, dormant, returning errors instead of data.

Wappalyzer sees the tag and reports the product as "in use." But it isn't. The subscription ended. Any sales rep relying on that data is chasing a dead lead.

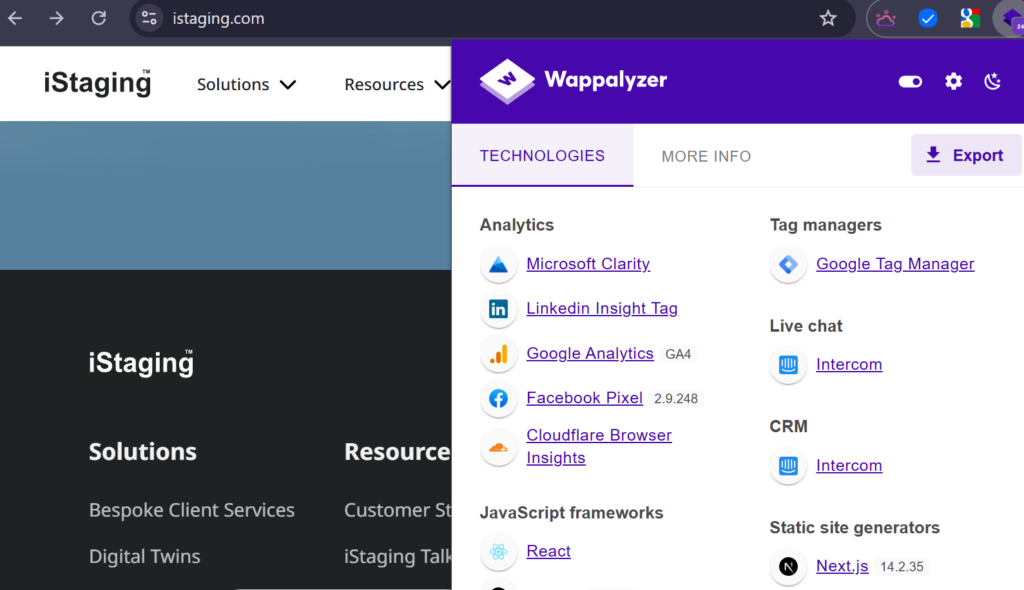

As an example, Wappalyzer mistakenly showed Intercom as a technology present for the website istaging.com:

However, if you fire up a JavaScript console and go to the Network tab, you'll see that the Intercom app was suspended (it returned a 403: Forbidden response), and that the website actually stopped using Intercom. Wappalyzer detected the presence of the Intercom JavaScript and mistakenly assumed they were still using Intercom.

Bloomberry verifies whether the integration is actually functional, not just present. When Shaker.io cancelled Intercom, we flagged it as churned on October 1st while Wappalyzer still shows them as active.

Coverage of Emerging Technologies

Wappalyzer is slow to add new vendors to their detection library. UnifyGTM, for example, has raised millions in VC funding and serves hundreds of customers. Wappalyzer returns zero results. Bloomberry tracks 20-30 new UnifyGTM sign-ups every month, giving you access to prospects that competitors can't see.

Full Tech Stack Lookups

Bloomberry also lets you do tech stack lookups for any company. But instead of showing you just the frontend technologies they use on their website, Bloomberry shows you all types of SaaS products they use – including CRMs, ERPs, DevOps tools, security products, and more.

Limitations

Bloomberry's coverage is focused rather than exhaustive. Because it prioritizes real-time accuracy and is geared toward sales and GTM teams, it doesn't track every website in existence – small blogs and one-person operations typically aren't in the database. Instead, it focuses on companies that are likely buyers of software – ie. companies with at least 5 employees.

Wappalyzer, with its crowdsourced model pulling data from thousands of browser extension users, will naturally have broader coverage of popular web technologies and smaller sites. If you need to identify tech stacks on niche or low-traffic websites, Wappalyzer might fill those gaps better.

Pricing

Bloomberry offers a free account to get started, and paid plans start at $199/month. It's available via both a UI and an API, and you can sign up for an account here.

Summary: Bloomberry vs Wappalyzer

After testing 10 different tools, Bloomberry stood out as the best Wappalyzer alternative for most sales and prospecting use cases. Here's a quick comparison:

| Bloomberry | Wappalyzer | |

|---|---|---|

| 📊 Technology Coverage | Web technologies + 1,200+ non-web B2B products (CRMs, ERPs, cybersecurity, DevOps, AI tools, etc.) | Frontend web technologies only (CMSs, JavaScript frameworks, analytics, ecommerce) |

| ⏱️ Data Refresh Speed | Real-time updates on technology adoption and churn | Periodic crawls with varying refresh rates |

| 🔔 Automated Alerts | Email & Slack notifications for new customers, churn events, and upcoming renewals | No alerting capabilities |

| 🎯 Churn Detection | Identifies when subscriptions end, even if scripts remain on the page | Only detects script removal, missing inactive or cancelled accounts |

| 💼 Best For | Sales teams targeting companies based on full tech stack + timing of tech changes | Developers and marketers researching individual website tech stacks |

If you're building a Wappalyzer alternative and want me to test it, feel free to email me with login details and a short note on what makes it different. I'm always curious to see new approaches in this space and may be able to include it in a future update of this list.