Last Updated: January 23, 2026

Signals are the rage in B2B sales and GTM teams right now. Every GTM tool from UnifyGTM to Clay are building signals right into their platform.

But which signals are actually a strong indicator that a company plans to upgrade their tech stack, and make more software purchases? Which signals actually indicate buyer intent?

Wel,l I decided to find out. So I analyzed 1 million B2B software purchases from March 17, 2025 to September 17, 2025 (using real-time purchase/churn data from Bloomberry) to correlate how well certain GTM signals predicted a future software purchase.

I know some of you are busy, so I listed all the signals I analyzed below so you can click on the one you’re most interested in 🙂

1. Signal: Recent increase in Headcount

Predictive Value: High

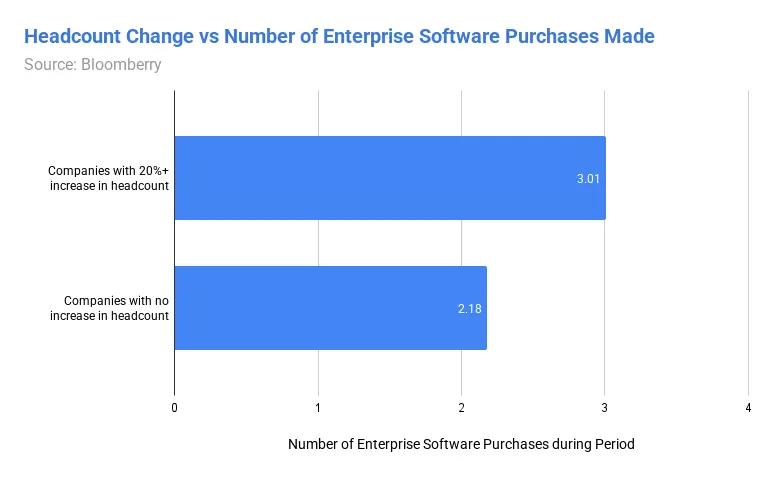

The first signal I analyzed was a recent increase in headcount. Do companies that grow in headcount buy more software than companies that didn’t increase head count?

To find out, I looked at companies that had 200-1000 employees at the start of the period. This was important because I wanted to control all the other variables and just look at 1 variable: headcount increase.

I compared the average number of software purchases made between 2 groups: companies that had a 20% or higher increase in headcount vs companies that didn’t have any increase in headcount.

I relied on Linkedin company page data to get the current and past headcount for each company (though I could’ve used data from a paid tool like PeopleDataLabs for more accurate data)

The result? Companies that had a 20%+ increase in headcount had an average of 3.01 software purchases, while companies that didn’t have any increase in headcount made an average of 2.18 purchases.

In other words, companies that recently increased headcount made 38% more software purchases than those that didn’t.

Companies that increased headcount were 65% more likely to purchase an internal knowledge base tool (ie Notion, Jira, Slite), 54% more likely to purchase an IT Help Desk tool (ie. ServiceNow) and 47% more likely to purchase a project management tool (ie. Confluence).

All of which make intuitive sense, because those tools become more critical as headcount grows.

2. Signal: Recent Funding Rounds

Predictive Value: Medium

Do startups that recently announced a funding round make more software purchases immediately following that funding?

To find out, I used Crunchbase data to analyze two cohorts: Startups that recently announced funding anytime this year (2025), and startups whose last funding date was before this year. I ignored startups that never had any funding at all, and I ignore funding rounds that weren’t Pre-Seed, Seed, or Series A, B, C, D, and E.

The result? Startups that recently had a funding round made 25% more software purchases (2.5) in the following 6 months than startups whose most recent funding round was in the past (2.0).

Unlike companies that increased headcount, there wasn’t a specific software category that recently funded startups were more likely to buy. Recently funded startups were 7% more likely to purchase website builder tools (ie Webflow) and 4% more likely to purchase a search engine optimization tool, but I didn’t view that as statistically significant.

3. Signal: Recently hired a VP

Predictive Value: Medium

Do companies that recently hire a VP make more software purchases than companies that didn’t hire a VP recently?

To find out, once again, I only looked at companies that had 200-1000 employees at the start of the period. I compared the average number of software purchases made between 2 groups: companies that hired a VP (ie VP of Sales, VP of Marketing, etc) any time during the time period, and companies that did not hire a VP any time during the period (but hired at least one non-VP).

The result? Companies that hired a VP had an average of 3.12 software purchases, while companies that didn’t hire a VP made an average of 2.44 purchases. In other words, companies that hired someone for a VP role made 28% more software purchases than companies that did not hire a VP.

VPs and executives often make technology changes, shortly after they get hired, so this made sense to me. They not only introduce their favorite tools, but get rid of existing ones. Which is why a lot of sales people use tools like UserGems to target people who had a recent leadership job change. They not only have autonomy, but they are also likely to revamp existing tools/systems shortly after joining the company.

4. Signal: Recent increase in job openings

Predictive Value: Low

The 4th signal I analyzed was an increase in job listings. Do companies with a significant increase in job openings buy more software than companies that didn’t have any increase in total job openings?

To be sure, this isn’t exactly the same as a headcount increase, as an increase in job openings could forbode an increase in headcount. It could be an early indicator.

To find out, once again, I only looked at companies that had 200-1000 employees at the start of the period. I compared the average number of software purchases made between 2 groups: companies that had a 20% or higher increase in total job openings vs companies that didn’t have any increase in total job openings. I relied on job openings data from Revealera to get the headcount for each employee.

The result? Companies that had a 20%+ increase in total job openings had an average of 2.82 software purchases, while companies that didn’t have any increase in total job openings made an average of 2.64 purchases. In other words, companies that increased job openings made just 7% more software purchases than those that didn’t.

At first I expected a much larger correlation. I thought companies that planned to hire more would inevitably have a higher budget, and needed more software to support the future expansion.

But perhaps, it might be too early of an indicator. If you intend to hire more customer service workers (but haven’t yet), it wouldn’t make sense to purchase customer service tools like Zendesk *until* after they’ve been hired, and you’re confident that you have a warm body that would actually be using it.

5. Signal: Recently bought an enterprise AI tool

Predictive Value: High

Do companies that recently purchased an enterprise AI productivity tool (ie ChatGPT for Teams, Claude for Work, Perplexity Enterprise) make more software purchases than companies that don’t?

To find out, I compared the average number of software purchases made between 2 groups: tech companies that purchased an enterprise AI productivity tool any time during the time period, and tech companies that did not during the period.

I kept factors like employee size the same between both of them by looking at just companies with 500-1000 employees. I also kept the industry the same by only looking at tech companies (Software Development, Technology, Information and Internet companies).

It turns out that purchasing an enterprise AI tool was the strongest predictor a company is planning to buy more tools. Companies that purchased an AI tool had an average of 4.2 software purchases (excluding the AI tool they purchased of course), while companies that didn’t had an average of 2.87 software purchases.

In other words, companies that purchased an enterprise AI tool made 46% more software purchases than those that didn’t.

What’s likely happening here isn’t that ChatGPT is becoming sentient and forcing CEOs to spend more money (I hope).

Instead, buying an enterprise AI tool is basically a signal that a company is in ‘upgrade everything’ mode. These are companies that have already decided to spend money on cutting-edge tools, have leadership teams that care about efficiency, and aren’t afraid to try new technology.

They’re probably doing a whole tech stack review, looking at what’s slowing them down across different departments, and purchasing tools that will help them become more efficient.

6. Signal: Recently made a software purchase

Predictive Value: High

Do companies that recently made a software purchase make more purchases in the next 6 months?

To find out, I compared the average number of software purchases made between 2 groups: “repeat recent buyers” ie. companies that made a software purchase in the 3 months prior to the buying period and the current period, and “new buyers” ie. companies that did not make a purchase in the 3 months prior but made a purchase in current period. Again, keeping company size 200-1000 employees.

Unsurprisingly, repeat buyers made 38% more purchases than new buyers.

Why is this the case? The simplest reason might be recent buyers simply have more budget allocated. They’re not just buying one tool and calling it done – they’re systematically addressing multiple operational needs with a predetermined budget.

Second, once companies start actively looking at their tech stack, they tend to find multiple issues that need solving. The first purchase often reveals other gaps or inefficiencies, creating a pipeline of additional needs. Or it could integrations that might need adding.

7. Signal: Recently achieved SOC compliance

Predictive Value: None

Do companies that recently achieved SOC compliance (ie by tracking companies that put up Security Trust Centers with vendors like Vanta and Drata) make more software purchases than companies that don’t?

For those of you that don’t know, SOC stands for Service Organization Control – it’s basically a rigorous third-party security audit that proves your company can be trusted with sensitive data and has proper security controls in place. Think of it as getting a gold star from auditors saying “yes, this company actually knows how to protect customer information and run their business properly”.

To find out, I compared the average number of software purchases made between 2 groups: companies that put up a Security Trust Center in the 6 month period vs companies that put up a Security Trust Center before the 6 month period.

It turns out there’s literally zero correlation between recently becoming SOC compliant and making more software purchases. Companies that recently became SOC compliant made an average of 3.34 purchases in the 6 month period, as opposed to 3.4 purchases by companies that were already SOC compliant before the period.

8. Signal: Recently opened a new office

Predictive Value: Low

Do companies that recently opened a new office purchase more software than companies that didn’t open a new office?

To find out, I used Linkedin to find companies that recently announced a new office opening publicly through their Linkedin page. These companies made on average 2.07 software purchases in the period, compared to 1.88 software purchases by companies that never announced a recent office opening.

In other words, companies that recently opened a new office made 11% more purchases than companies that didn’t open a new office (or never announced it) – a weak predictive signal.

To be fair, my methodology for finding companies with recent office openings wasn’t as robust as I would prefer, but it was the best I could do, as there isn’t a free dataset anywhere with new office openings. But analyzing Linkedin posts for ones that mention “new office” was the best proxy I had.

The Bottom Line

After analyzing 1 million software purchases, here’s what actually matters for sales teams identifying companies ready to buy: look for companies adopting enterprise AI tools, making recent tech stack changes, rapidly growing their headcount. These are your highest-intent prospects.

The AI signal is particularly powerful because it reveals companies in active modernization mode – they’re not just maintaining their current setup, they’re systematically upgrading everything.

Headcount growth works similarly but for different reasons – companies adding 20% more employees aren’t just hiring for the sake of it, they’re scaling operations that inevitably require new software infrastructure.

Growing teams need project management tools, communication platforms, and specialized software to handle increased complexity. Recent funding and VP hires also indicate elevated buying activity, but to a lesser degree.

📊 See which companies use these tools

Explore adoption data for the intent and sales intelligence tools that capture buyer signals: